Providing value to the bank’s corporate customers through automation technology

Give your customers the tools to optimise their internal payment preparation process and add value to your relationship

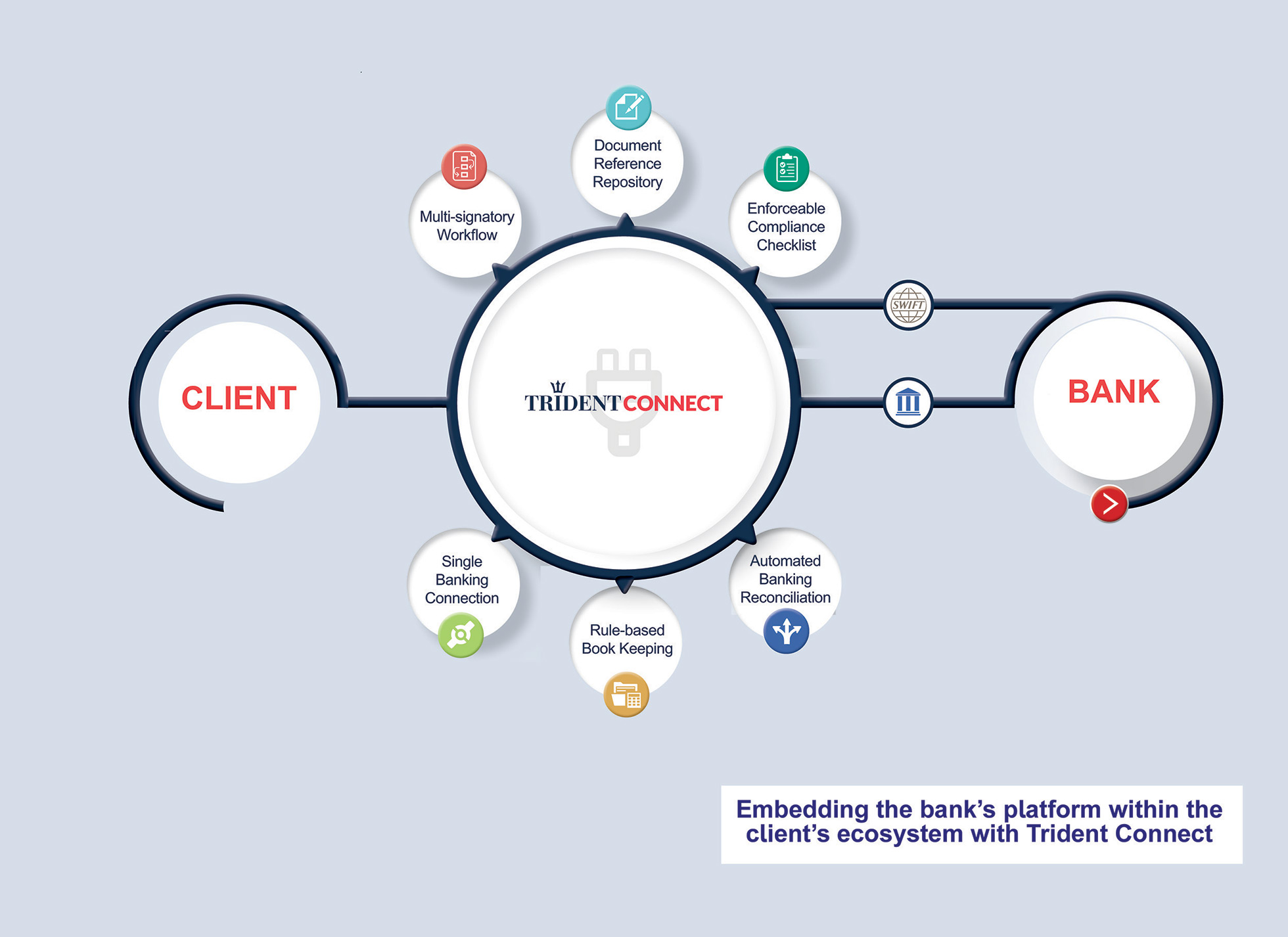

Embedding banking systems within the corporate customer’s ecosystem

Banks today are facing multiple pressure points due to open banking, the emergence of new entrants, and a changing customer profile. So they need to optimise their operations to counter the pressure on margins, and manage this change while embracing new technologies before their competitors do so.

They also need to find ways to leverage their strengths, in the form of the trust they have built with their existing corporate customers over the years, to protect themselves from this disruption.

For players in this vertical, one of the most effective ways to strengthen the relationship with their corporate customers is by embedding their technology services within the customer’s ecosystem, creating a more direct and permanent link.

One way to achieve this effectively is through technology, such as Trident Connect, which is focused on optimising the payment approval process by offering seamless integration between the customer’s internal systems and the bank.

Our solutions can enforce and facilitate approval workflows and compliance checks as well as significantly reduce integration pains with banks, removing the need for multiple fobs. A further significant benefit to the end client is the automated bookkeeping (transaction posting) into the organisation’s internal systems and a three-way bank reconciliation.

Trident Connect sits between the customer’s ERP or accounting system at one end, and your bank at the other, and provides your corporate customers with an intuitive tool that automates and enforces the payment approval process and compliance checks, and after that connects to the bank automatically to affect payment.

Following payment approval, there is automated bookkeeping into your customer’s internal systems and a three-way bank reconciliation.

The Power of Automation for a bank’s corporate customers

Risk

Reduction

Through enforceable checklists and compliance.

Improved

Efficiency

Through a simplified, end-to-end payment approval process and post-payment operations.

Increased

Visibility

360-degree visibility of the organisation’s payments position.

Better customer

experience

Provide your corporate customers with tools to deliver a consistent service to their customers.

The Advantages of embedding technology within a customer’s ecosystem

Increased

Success Rates

Higher percentage of successful payments due to enforced rules

Provide

more value

In the form of a more streamlined payment process.

Reduce

Risk

Due to more stringent compliance, enforced processes and checklists.

Better customer

retention

Customers will see an increased value in the relationship.

Moving from a manual and legacy system based payment process to automation

01

Integrating Legacy Systems

Determining how information flows from system to system and to external providers to be able to integrate all components within an end-to-end workflow.

02

Optimising & Enforcing Workflow

Identifying the current processes and multiple approval levels and determine which processes should be enforced.

03

Integration to the Bank

Automated payment processing through the banking platform.

04

Bookkeeping & Reconciliation

Ensuring that all the data in ERP / Accounting System, the bank and Trident show the same picture.