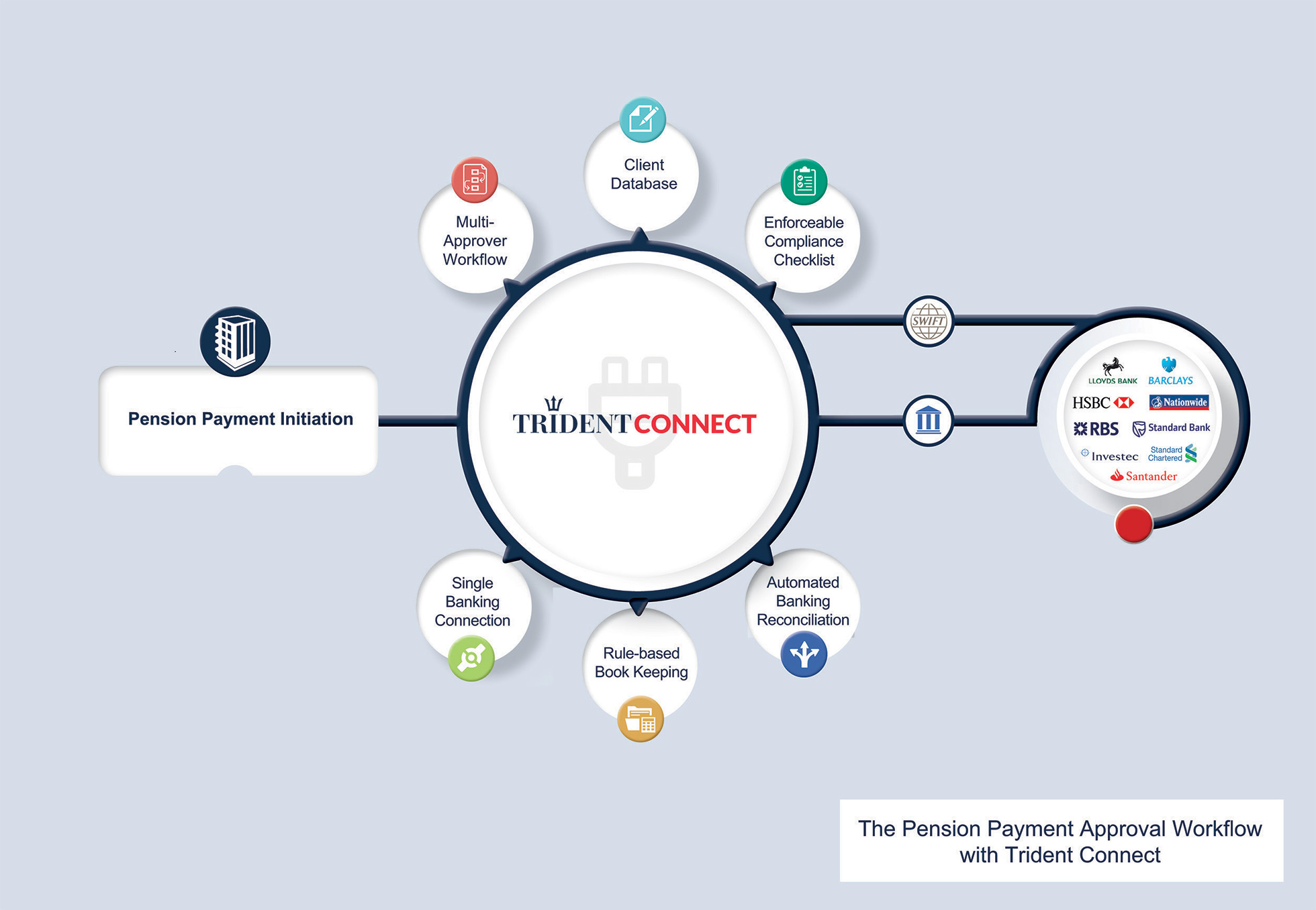

Automating the Private Pensions payment approval process

Optimise and de-risk the Pensions Payment Approval process by moving from a manual and legacy system based payment workflow to an end-to-end automated process.

Increasing efficiency and reducing risk in Private Pensions Payment processing

Many times, the process leading to the approval of payments in pensions, whether for monthly payments or lump-sum, are predominately manual or based on siloed legacy systems. This leads to processes that are inefficient, expensive to run and risk-laden, leading to potential errors and related reputational damage, missed deadlines, and issues that may arise from a lack of compliance visibility.

The pitfalls involved are directly the result of processes that include multiple touchpoints, and the array of decisions that would need to be made at every one of these points. This is also compounded by the complex reporting requirements and the stringent compliance required from private pensions regulators.

The Trident suite provides a number of solutions that could bring significant improvements and cost reductions to such processes within the organisation.

Sitting in between your internal application/s and the banks, our tools provide the necessary workflows and approval ‘gates’ required to automate this process.

The Power of Automation

Better customer

experience

Allow customers to be part of the process which is built around their needs and ensures consistent delivery.

Improve

Efficiency

Reduce duplication of effort due to manual inputting in multiple systems.

Reduce

Risk

Reduce reputational risk through enforced processes.

Reduce

Costs

Decrease pension payments approval times and costs.

Moving from a manual and legacy system based pension payment process to automation

01

Integrating Legacy Systems

Determining how information flows from system to system and to external providers to be able to integrate all components within an end-to-end workflow.

02

Optimising & Enforcing Workflow

Identifying the current processes and multiple approval levels and determine which processes should be enforced.

03

Integration to the Banks

Automated payment processing through the banking platforms.

04

Bookkeeping & Reconciliation

Ensuring that all the data in ERP / Accounting System, the bank and Trident show the same picture.