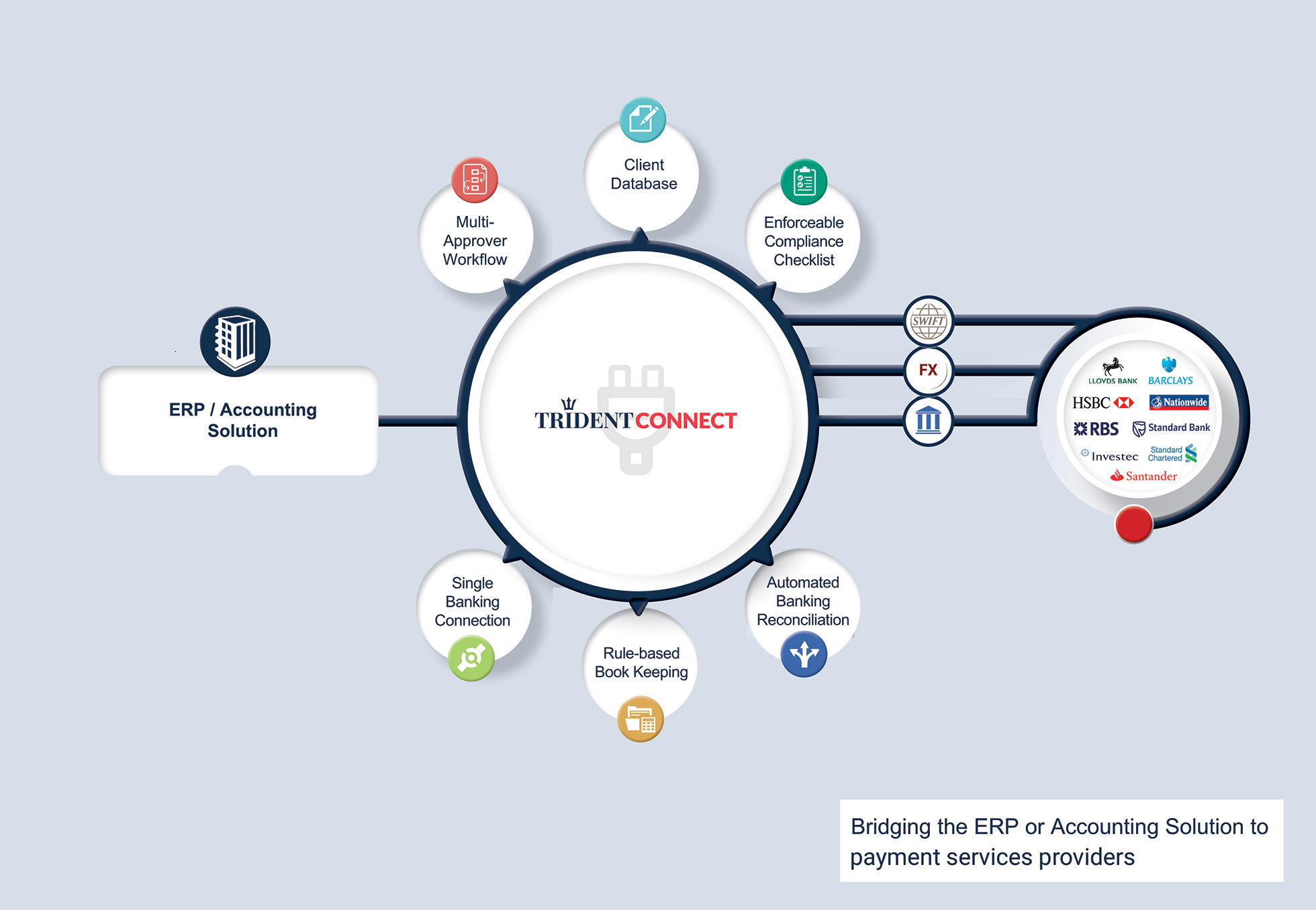

Integrating internal systems and payment service providers

Automation and Integration solutions to ERP and Accounting Solution providers to connect to payment services in an end-to-end automated process.

Add payment functionality to your ERP or accounting solution

Trident Bridge connects ERPs and accounting solutions to payment services providers, whether these are banks, forex suppliers, liquidity providers or other service providers.

The solution converts the payment instructions generated by the ERP or accounting solution, which would normally be destined for a bank, into instructions to be managed by the payment services provider.

Embedding payment technology within the customer’s ecosystem

Increase

Functionality

Cover more processes in your customers’ operations

Provide

more value

In the form of a more streamlined payment process.

Reduced

Cost & Risk

Give the customer added benefits with more stringent compliance, enforced processes and checklists.

Better customer

retention

Customers will see an increased value in the relationship.

Moving from a manual and legacy system based payment process to automation

01

Integrating Legacy Systems

Determining how information flows from system to system and to external providers to be able to integrate all components within an end-to-end workflow.

02

Optimising & Enforcing Workflow

Identifying the current processes and multiple approval levels and determine which processes should be enforced.

03

Integration to the Banks

Automated payment processing through the banking platforms.

04

Bookkeeping & Reconciliation

Ensuring that all the data in ERP / Accounting System, the bank and Trident show the same picture.